Building a Better Manitou Springs

Economic Development

Business + Community + Environment

More than just a tourist town

Here you’ll find resources for Manitou Springs businesses and employers. With an historically tourism-dependent economy, the Manitou Springs Chamber of Commerce, Visitors Bureau & Office of Economic Development is committed to providing resources to help diversify the local economy.

Job Listings

Is your business hiring?

If your business is hiring, please fill out the form below with the job title, a brief job description, end date for applicants to apply by, the point of contact, as well as your preferred method of contact for applications. We will streamline the process for you and post your job listing on our website!

The report is in

The Economic Development Plan

A two year action-plan for the Manitou Spring Chamber of Commerce in support of the definitions, visions, and plans of the City of Manitou Springs.

Business FAQs

We are happy to support local businesses and start-ups. Here are the answers to some of our more frequently asked questions. If your question isn’t answered here, feel free to give us a call or stop in the office. We look forward to meeting you!

A business license is required for all businesses operating in Manitou Springs for more than seven (7) days in any calendar year. Business licenses can be obtained through the City of Manitou Springs Finance Department.

Visit the Business Page on the City of Manitou Springs website for more information.

Businesses are required to pay a 3.5% Use Tax on all purchases made outside of Manitou Springs for business operations within the city including, but not limited to Fixtures, Decor, Computers and Programs, Dishes, Linens, etc. You may submit your Use Tax when you apply for or renew your Business License, but you may monthly depending on the size and preference of your business.

Once Use Tax has been figured on the Use Tax Form, payment can be remitted via mail by check or in person by check, cash, or credit card to the Finance Department.

Renewal in the Gateway to Manitou area is happening now! The City is encouraging investors to take advantage of this opportunity to invest in our community. The City of Manitou Springs and the Manitou Springs Urban Renewal Authority are readily available to work with you to help make your plans a reality.

Visit msura.org to learn more!

Looking out for Small Business

Revolving Loan Fund

In 2018 we launched a low-interest, revolving loan fund program to assist Manitou Springs businesses impacted by construction, utility work, and other factors. The Chamber partnered with the City, Vectra Bank, Manitou Springs Urban Renewal Authority, Pikes Peak Bulletin, Accion Microfinance Bank, and community members to create this fund.

The Chamber will issue the loans while chamber members, Vectra, Accion, and the Small Business Development Center will serve as advisors. Manitou Springs businesses are eligible for loans of up to $10,000 and have access to low-cost or free consulting support.

For more information, give us a call at (719) 685-5089.

The tip of the iceberg

Join the Chamber

Do you want access to liaisons working to communicate your needs with City officials? Are you looking for increased digital and print presence? Look no further than the Manitou Springs Chamber of Commerce. We are happy to support local businesses who help us grow the local economy and create a resilient community.

It Pays to Do Business in Manitou

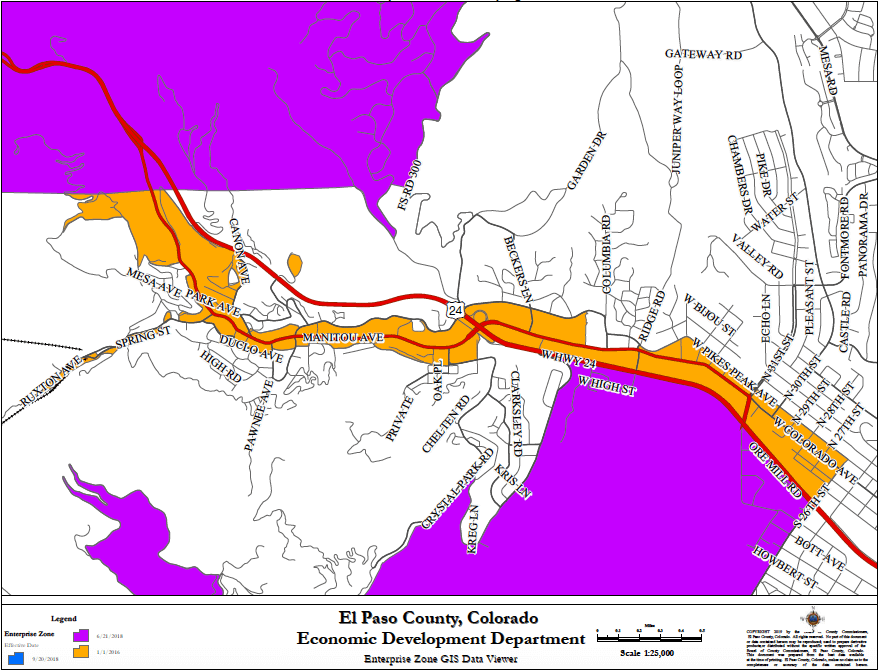

Pikes Peak Enterprise Zone

Colorado’s Enterprise Zone program provides tax credits and incentives to businesses and projects that invest in economically depressed regions. All commercially zoned property in Manitou Springs falls within the Pikes Peak Enterprise Zone, and any business located within this zone that operates legally under both state and federal law is eligible to participate.** Participating businesses could save on their Colorado income tax bill for:

- Research and Development

- Employee training

- New hires

- Capital investments

- Employee training

- Rehabilitation of old and vacant buildings

**Marijuana-related businesses may not be legal at the federal level.

Activities that will earn business tax credits require annual pre-certification prior to the start of any eligible projects or activity.

Pre-certification is a simple process that can be done online at the Colorado Office of Economic Development and International Trade website. It can be completed up to three months prior to the start date of the business’ tax year. Pre-certification is approved or denied by the PPEZ Administrator.

After eligible activities have been completed, a pre-certified business must then complete a certification application and receive PPEZ Administrator approval. All certification documents must be included with your Colorado income tax filing.

For more information about eligibility and tax credits available as part of the PPEZ, visit the El Paso County website here.

- Investment Tax Credit: Investments in business personal property may earn a 3% tax credit.

- Job Training: Qualified job-training programs may earn a 12% tax credit for training costs.

- New Employee: Businesses may earn a $1,100 tax credit per net new employee.

- Agricultural Processor New Employee Credit: Business may earn a $500 tac credit per net new employee.

- Employer-Sponsored Health Insurance: Where the employer pays 50% of the cost for a qualified health plan, businesses may earn $1,000 per net new employee for the first years of operation in the PPEZ.

- Research and Development: Increased R&D may earn businesses a 3% tax credit on the increase in spending compared to the previous two (2) years.

- Vacant Commercial Building Rehabilitation: Buildings that are 20+ years old and have been vacant for at least two (2) years are eligible for a 25% credit for the cost of rehab, up to $50,000 per building.

- Commercial Vehicle Investment: Commercial vehicles or replacement parts for vehicles registered in Colorado and based in the PPEZ may earn a 1.5% tax credit on eligible expenditures.

- Contribution Projects: Colorado taxpayers may earn a 25% state income tax credit for contributions to registered projects.

- Sales and Use Tax Exemption: The purchase of manufacturing machinery and materials are exempt from the State and County sales and use tax.

Existing Community Plans

Manitou Springs is a uniquely engaged community. Here you’ll find links to existing plans and documents related to economic development and the community vision.

Gateway to Gateway

The Chamber of Commerce engaged DCI in 2018 to assist in building stronger partnerships and capacity using existing community plans.

Plan Manitou

Plan Manitou is the 2017 comprehensive plan and roadmap to guide future growth, support sustainability, and assure resiliency in the face of future challenges.

County Eco Devo Report

This 2014 document offers suggestions related to disaster recovery and general economic development strategies to be used in future planning and implementation efforts to improve the local economy.

Manitou Springs Forward

A 2012 community plan committed to economic vitality and sustainability, as well as, protect our heritage, natural beauty assets for arts, culture, life-long learning, and well-being.